- Reduced costs

- Improved compliance

- Reduced customer journey time from 3+ days to 15 minutes

- Automated key business processes

- Doubled revenue in 6 months

Customer Profile

- Financial services

- Largest credit union in Europe

- Over 50,000 customers

About Glasgow Credit Union (GCU)

Originally situated in a small office within Glasgow City Chambers with two members of staff, GCU has grown substantially during the past four decades to become the most financially successful credit union in the UK. GCU are now the largest credit union in Europe that prides itself on offering cutting-edge lending solutions to its 50,000 customers.

Challenges

The process of joining GCU and applying for a loan was time consuming due to manual intervention (it took at least 3 days), which in turn limited the Union’s capacity for taking on new members.

GCU were outsourcing their scanning of loan agreements to an archive company every three months (15-20,000 loan agreements being scanned off-site per annum) resulting in a delay in information being available electronically.

”I’ve been amazed by how simple it’s been to take a document management solution and integrate it with multiple other pieces of technology and our existing processes.

Our vision is to be the lender of choice within our market, Agilico and Laserfiche has helped us achieve that.

Head of Operations Director, Glasgow Credit Union

The Solution

Glasgow Credit Union opted for a Laserfiche Enterprise Content Management platform, leading to significant benefits.

By bringing the scanning of their loan agreements in-house, the credit union was able to reduce costs, saving £19,000 annually.

The implementation of retention schedules streamlined document management, ensuring that staff were quickly notified when documents were due for disposal, improving compliance with document retention policies.

The adoption of this platform transformed the customer experience. The joining and borrowing processes became more flexible, allowing customers to proceed at their own pace, even outside of traditional business hours. This flexibility has resolved capacity issues and enabled large volumes of documents to be handled with a similar level of resources.

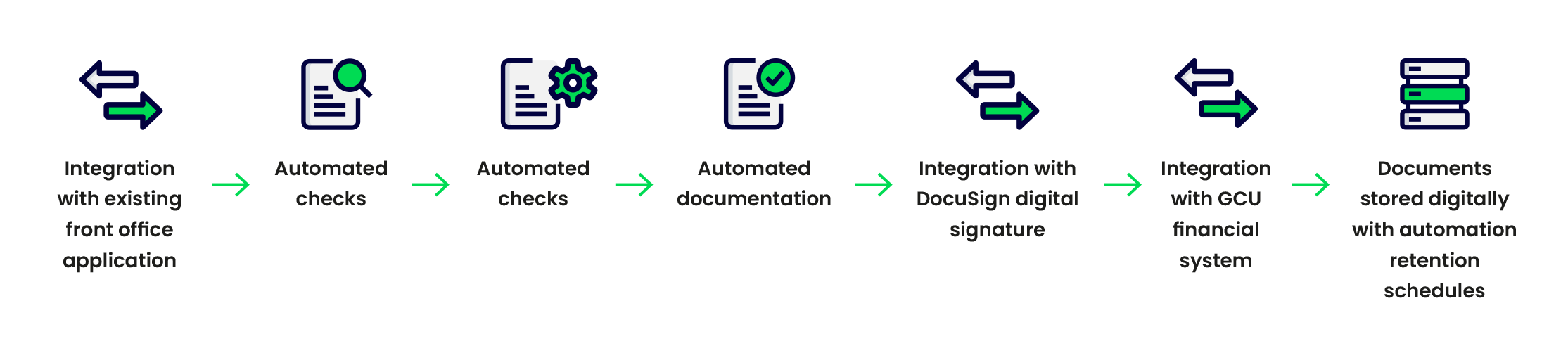

The integration of automation, digital signatures, and connectivity with GCU’s finance system has transformed the lending process. What previously took over three days for decision-making now takes as little as 15 minutes, enhancing the overall customer journey. The efficiency gains were not limited to customer-facing operations; process automation also resulted in a remarkable reduction of 150 labour hours per week. These saved hours were redeployed to other areas of the business, contributing to the growth of GCU’s lending business.

Within six months of implementing the automated lending system, GCU doubled the revenue in its lending business.